All Categories

Featured

Table of Contents

The SEC controls the policies for purchasing and offering safeties including when and how protections or offerings should be signed up with the SEC and what sorts of financiers can join a particular offering - alternative investments for accredited investors. As an online commercial property investing marketplace, every one of our financial investment opportunities are available only to certified capitalists

Put simply, you're an accredited capitalist if: OR ORYou are a holder in good standing of the Series 7, Collection 65, or Series 82 licenses An accredited capitalist does not have to be a private person; trusts, specific retired life accounts, and LLCs may additionally receive recognized capitalist status. Each spending capacity may have somewhat different criteria to be considered recognized, and this flowchart details the certification requirements for all entity kinds.

Within the 'certification verification' tab of your, you will certainly be offered the adhering to alternatives. Upload financials and documents to show proof of your recognized standing based upon the demands summarized above. attesting to your standing as a certified capitalist. The uploaded letter needs to: Be authorized and dated by a certified third-party; AND Clearly state the providers credentials (ex-spouse, "I am a signed up CPA in the State of [], certificate #"); AND explicitly state that the investor/entity is a recognized investor (as specified by Regulation 501a).

Proven Accredited Property Investment

Please note that third-party letters are just legitimate for 90 days from day of issuance. Per SEC Guideline 230.506(c)( 2 )(C), before approving a financier right into an offering, sponsors should obtain written proof of a capitalist's certification status from a qualified third-party. If a third-party letter is given, this will be passed to the enroller directly and has to be dated within the past 90 days.

After a year, we will require upgraded monetary papers for review. For more details on accredited investing, visit our Accreditation Overview Articles in our Aid.

The test is anticipated to be available at some time in mid to late 2024. The Equal Chance for All Investors Act has actually currently taken a significant step by passing the Home of Reps with a frustrating vote of assistance (383-18). opportunities for accredited investors. The next stage in the legal procedure involves the Act being examined and voted upon in the Us senate

Profitable Accredited Crowdfunding Near Me – Oklahoma City OK

Provided the rate that it is moving already, this could be in the coming months. While precise timelines are uncertain, given the significant bipartisan support behind this Act, it is anticipated to progress via the legislative procedure with family member speed. Assuming the one-year window is supplied and attained, indicates the text would certainly be readily available sometime in mid to late 2024.

For the ordinary financier, the economic landscape can in some cases feel like an intricate maze with limited accessibility to particular financial investment opportunities. Nevertheless, within this realm exists an unique classification referred to as recognized investors. If you've ever wondered what sets accredited investors apart, this write-up offers an overview. The majority of financiers do not qualify for recognized investor condition due to high earnings degree demands.

High-Quality Secure Investments For Accredited Investors Near Me (Oklahoma City OK)

Join us as we demystify the world of recognized investors, deciphering the definition, requirements, and possible benefits connected with this designation. Whether you're brand-new to spending or seeking to increase your economic horizons, we'll shed light on what it indicates to be an accredited investor. While services and banks can get approved for recognized investments, for the purposes of this article, we'll be reviewing what it indicates to be a certified financier as a person.

Private equity is also an illiquid property class that seeks lasting appreciation away from public markets. 3 Private placements are sales of equity or financial debt settings to professional capitalists and organizations. This sort of financial investment typically functions as an option to other strategies that may be taken to increase capital.

7,8 There are a number of drawbacks when thinking about an investment as a recognized financier. 2 The financial investment vehicles used to recognized financiers commonly have high investment requirements.

2 Hedge funds, in specific, might have connected fees, such as efficiency and monitoring costs. An efficiency cost is paid based on returns on an investment and can vary as high as 15% to 20%. This is on top of monitoring costs. 9 Several certified financial investment cars aren't conveniently made fluid must the need occur.

Best Growth Opportunities For Accredited Investors – Oklahoma City OK

The info in this material is not meant as tax or legal suggestions. It may not be utilized for the function of avoiding any federal tax obligation fines. Please speak with lawful or tax obligation specialists for particular details concerning your individual circumstance. This product was established and generated by FMG Collection to give information on a subject that may be of passion.

The viewpoints expressed and material provided are for basic details, and should not be thought about a solicitation for the purchase or sale of any kind of protection. Copyright FMG Collection.

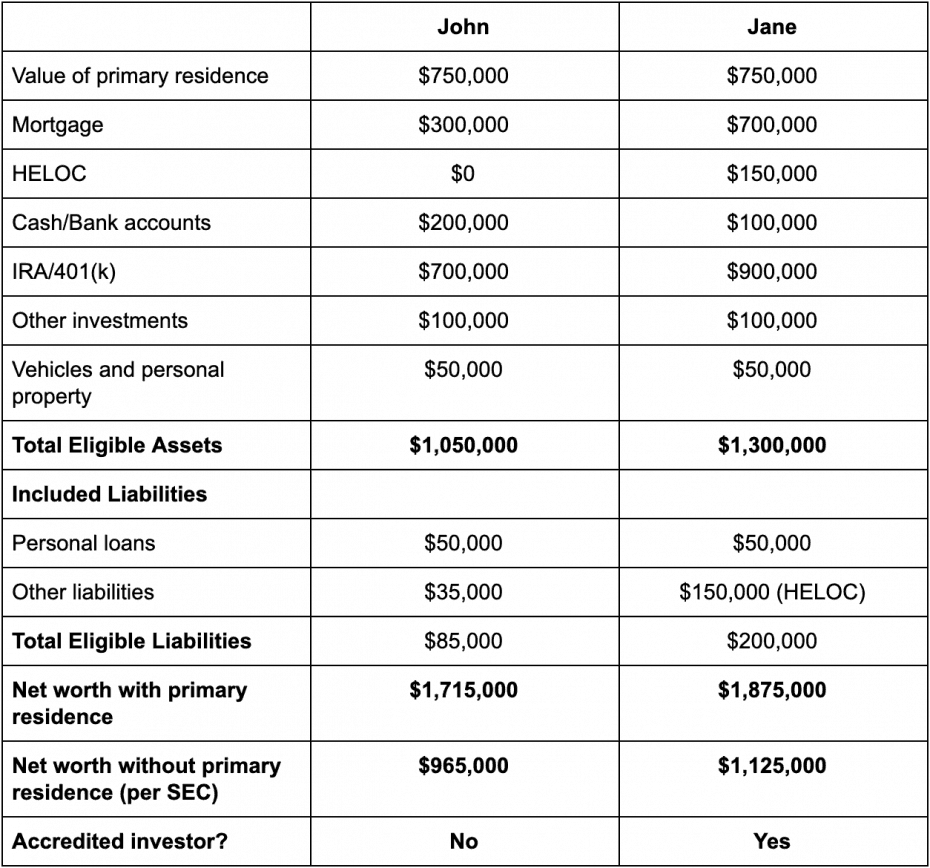

Certified financiers include high-net-worth people, banks, insurer, brokers, and depends on. Recognized capitalists are defined by the SEC as certified to purchase complicated or innovative kinds of safeties that are not closely controlled. Particular requirements need to be met, such as having an average annual income over $200,000 ($300,000 with a partner or residential partner) or functioning in the financial market.

Unregistered safety and securities are naturally riskier because they do not have the normal disclosure needs that come with SEC registration., and various bargains involving facility and higher-risk investments and instruments. A company that is looking for to raise a round of financing might make a decision to straight come close to recognized capitalists.

High-Quality High Yield Investments For Accredited Investors – Oklahoma City

It is not a public business yet hopes to launch a going public (IPO) in the future. Such a business might decide to use safeties to certified financiers straight. This kind of share offering is described as a private placement. For accredited capitalists, there is a high capacity for risk or reward.

The policies for recognized financiers vary amongst territories. In the U.S, the meaning of a recognized investor is presented by the SEC in Rule 501 of Law D. To be a recognized investor, an individual should have a yearly revenue surpassing $200,000 ($300,000 for joint income) for the last two years with the assumption of making the exact same or a greater income in the present year.

This amount can not include a main house., executive policemans, or directors of a firm that is providing unregistered securities.

Likewise, if an entity consists of equity proprietors that are accredited capitalists, the entity itself is an accredited financier. Nevertheless, a company can not be created with the sole purpose of buying details protections. A person can certify as an accredited investor by demonstrating adequate education and learning or work experience in the financial industry.

Table of Contents

Latest Posts

Excess Proceeds

Tax Delinquent Property Sales

2020 Delinquent Tax List

More

Latest Posts

Excess Proceeds

Tax Delinquent Property Sales

2020 Delinquent Tax List